An accounting worksheet is a tool used to determine the accuracy of the financial statements prepared by a company at the end of the accounting period. It also assists in keeping track of the steps involved in the accounting cycle.

It’s essentially a spreadsheet used specifically for internal purposes and not meant to be seen or used by external stakeholders like shareholders, creditors, etc.

The Accounting Cycle Example

Throughout this series on the accounting cycle, we will look at an example business, Bob’s Donut Shoppe, Inc., to help understand the concepts of each part of the accounting cycle. Below is the complete list of accounting cycle tutorials:

- Journal Entries

- T-Accounts

- Unadjusted Trial Balance

- Adjusting Entries

- Adjusted Trial Balance

- Preparing Financial Statements

- Accounting Worksheet (you are here)

- Closing Entries

- Income Summary Account

- Post-Closing Trial Balance

- Reversing Entries

We also have an accompanying spreadsheet which shows you an example of each step.

Click here to download the Accounting Cycle template

Accounting Worksheet Benefits

The accounting worksheet simplifies the process of creating financial statements for each accounting period. Additionally, for already created financial statements, an accounting worksheet can be used to investigate why they might not be balancing.

It serves as an analytical and a summary tool to reflect how the accounts had been initially posted, the adjustment entries made and the final presentation in the form of financial statements.

Using an accounting worksheet is a reliable process to determine the financial health of a company even before the financial statements have been prepared.

Due to the internal nature of this spreadsheet, the format of it can vary from company to company as per requirements—there is no standard format.

Accounting Worksheet Limitations

We have looked into the several advantages that an accounting worksheet provides. However, some limitations can exist as well:

- Since it is a labor-intensive process and requires human effort (if not automated), there are always chances of errors or inconsistencies.

- It cannot avoid errors of omissions.

- Duplicate entries are possible.

- Other others could exist too.

Accounting Worksheet Preparation

There are usually five columns of data with each column sub-divided into a debit and a credit column.

Unadjusted Trial Balance

This is the first column in an accounting worksheet and will include all the components that are part of the unadjusted trial balance such as revenue accounts, expense accounts, assets accounts, etc. The total of the debit columns for this should be equal to the total of the credit column. If not, this would mean there has been an error in the preceding steps of the accounting cycle.

Adjusting Entries

Adjusting items would make up the second column. The debit and credit column should match here again.

Adjusted Trial Balance

The adjusted trial balance is simply a combination of the unadjusted trial balance and the adjusting entries.

Income Statement

This income statement column will contain values pertaining to only the revenues and expenses accounts. If the total revenues exceed the expenses, then the difference will be recorded as net income for the year. The opposite will hold if expenses are more than revenues and a net loss would be recorded. In either case, a balancing entry is needed to be passed by the company.

Balance Sheet

This is the last column on the accounting worksheet and will include the assets, liabilities and equity accounts. Like the other columns, the total of debit and credit should match here as well.

Accounting Worksheet Example

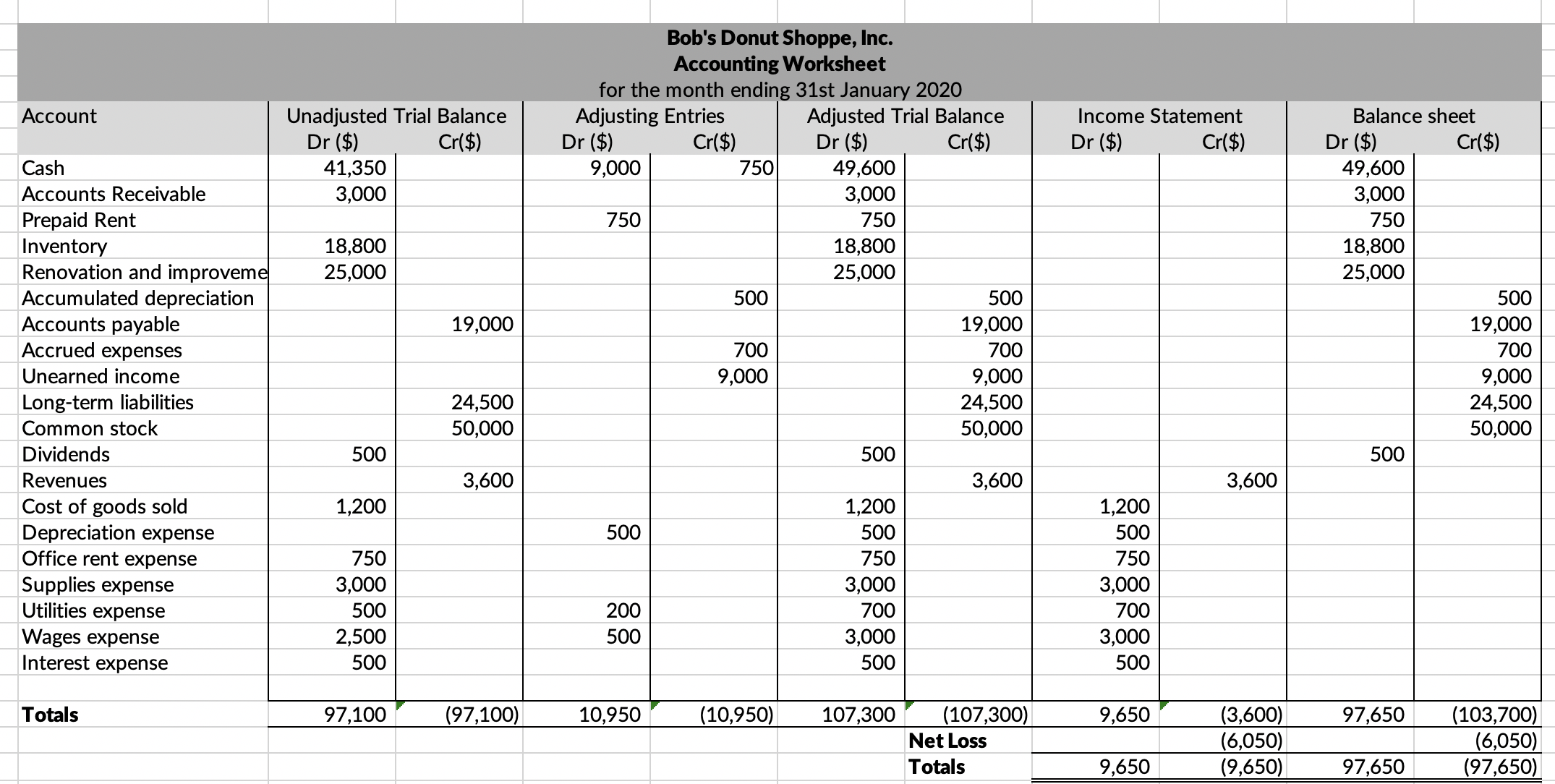

We have already covered how Bob’s financial statements were prepared and presented. The next step for Bob’s bookkeeper is to create an accounting worksheet to ensure that all of it ties together.

His accounting worksheet would look something like this:

Below are some important points regarding Bob’s accounting worksheet:

- This accounting worksheet is an internal document and has been prepared for internal management consumption only. External shareholders, creditors or prospective investors can use the financial statements for their decision making.

- It begins with a list of all accounts such as revenue, expense, assets, liabilities and equity in the unadjusted trial balance. These have been compiled by posting journal entries to their ledgers and from there the balances have been transferred to the unadjusted trial balance report.

- Adjusting entries are then prepared for Bob’s company to account for revenue and expenses that are related to this period but haven’t been paid out yet. This follows the accounting concept of match and accrual accounting.

- After adjusting entries have been made, the ledger balances are recalculated and posted to the adjusted trial balance. This report would include additional accounts such as depreciation expense, accumulated depreciation, prepaid rent, unearned income, etc.

- The income statement for Bob is the combination of operating revenues, operating expenses, non-operating revenues and non-operating expenses. You will usually find the revenue and expense accounts related to the incomes statement at the very end as per chronological order defined by the accounting worksheet.

- The balance sheet for Bob includes asset accounts like renovations and improvements, cash, accounts receivable, prepaid rent and inventory. The liability accounts for Bob and his company include accounts payable, accrued expenses, unearned income and long-term liabilities. The equity accounts consist of common stock, dividend and retained earnings.

Accounting Worksheet Conclusion

In summary, an accounting worksheet is an internal document for the accounting department to analyze the accounts and its balances. It is a useful mechanism to identify any accounting errors that could have been made in the accounting process thus far. All the company records are shown in one sheet in different columns; thus, it is easier for a bookkeeper to visualize the whole process up to the point of creation of financial statements.

While a company doesn’t need to prepare an accounting worksheet, it is still a useful process and it is highly recommended to prepare one.

Next Step

The next step in the accounting cycle is to create closing entries. These are manual journal entries at the end of an accounting cycle to close out all the temporary accounts and shift their balances to permanent accounts. In other words, temporary accounts are reset for the recording of transactions for the next accounting period. By doing so, companies move the temporary account balances to the permanent accounts of the balance sheet. We will discuss this in more detail in the next section.

Frequently Asked Questions

What is an accounting worksheet?

An accounting worksheet is a document where all the company records are shown in one sheet in different columns.

How do you write an accounting worksheet?

An accounting worksheet follows the following sequence:

i. Revenue accounts are listed in the first column;

ii. Expense accounts are listed in the second column;

iii. Asset, liability, and equity accounts are listed according to chronological order;

iv. All ledger balances (both primary and secondary) are posted to the unadjusted trial balance;

v. Adjusting entries are then prepared for the company to account for revenue and expenses that have been earned but not yet received. This follows the accounting concept of match and accrual accounting;

vi. After adjusting entries have been made, the ledger balances are recalculated and posted to a new adjusted trial balance report. This includes additional accounts such as depreciation expense, accumulated depreciation, prepaid rent, unearned income, etc.

vii. The report concludes with the presentation of a company income statement and balance sheet for a specific period of time.

What is the purpose of a worksheet?

The main purpose of an accounting worksheet is to help identify any errors that could have been made in the accounting process. This is the first step you will take before preparing financial statements.

For example, if a bookkeeper accidentally posts the wrong account as income, or if he is not sure about an entry and posts it as a temporary account to figure it out later, this mistake will be identified by the accounting worksheet.

By doing so, you can fix these mistakes before they make their way into financial statements.

Is a worksheet a journal?

No, a worksheet is not a journal. Neither is it part of the general journal.

Journal entries are for recording financial transactions, while an accounting worksheet is used to prepare adjusting entries. Closing entries are also included in the accounting worksheet.

Is a worksheet a permanent accounting record?

A worksheet is a temporary accounting record. It will be used to prepare adjusting entries that might need to be changed once the company receives more information.

For example, if revenue has been recorded from a customer but payment has not been received yet, this information will need to be updated once the cash comes in.

For this reason, a worksheet can be used to prepare at least two sets of financial statements.