The income summary is an intermediate account to which the balances of the revenue and expenses are transferred at the end of the accounting cycle through the closing entries. This way each temporary account can be reset and start with a zero balance in the next accounting period.

The credit balance of the revenue account is transferred by debiting the revenue account and crediting the income summary account. Similarly, the debit balances on the expense’s accounts are transferred and zeroed out by debiting the income summary and crediting the individual expenses account.

The Accounting Cycle Example

Throughout this series on the accounting cycle, we will look at an example business, Bob’s Donut Shoppe, Inc., to help understand the concepts of each part of the accounting cycle. Below is the complete list of accounting cycle tutorials:

- Journal Entries

- T-Accounts

- Unadjusted Trial Balance

- Adjusting Entries

- Adjusted Trial Balance

- Preparing Financial Statements

- Accounting Worksheet

- Closing Entries

- Income Summary Account (you are here)

- Post-Closing Trial Balance

- Reversing Entries

We also have an accompanying spreadsheet which shows you an example of each step.

Click here to download the Accounting Cycle template

Income Summary Advantages

The advantages of having an income summary account are the following:

- It gives complete information related to the revenue and expenses of the company in one place

- Useful for investors and shareholders to determine the financial performance of a company for a given time period and make key decisions accordingly

- Income summary accounts of the previous periods can be studied for a comparative analysis

- Helps in tax filing as all the relevant information is in one summary account

- To ensure that the profit and loss amount has been correctly calculated

- To provide an audit trail for the accounts to know where the amounts have been transferred

Income Summary Disadvantages

Some of the disadvantages of an income summary also discussed below:

- It does not tell you about the cash flow situation of a company. Even though the income summary might have a positive balance showing a profit for the year, the actual cash outflows of a company might be exceeding the cash inflows.

- The income summary account shows performance for only one period. Therefore, making a comparative analysis with other periods would require the accountant or investor to take out the last 5 to 10 years of summaries. This is a time-consuming job and sometimes it is not possible to get data that far back for non-listed companies.

The income summary account has two sides: a debit and a credit side. If the credit side exceeds the debit side, the company has made a profit. On the other hand, if the debit side exceeds the credit side, the company has made a net loss in its books for the accounting period.

Once the temporary accounts have all been closed and balances have been transferred to the income summary account, the income summary account balance is transferred to the capital account or retained earnings.

Income Summary vs Income Statement

There is often confusion between these two concepts due to their similar name. The following are some of the differences:

- The income statement is a permanent account that reflects the revenue and expenses of a company for a given period. The income summary, on the other hand, is a temporary account that is useful for only closing the revenue and expenses accounts and transferring the balance to retained earnings.

- The income statement is a financial statement. The revenue and expense account balances on the income statement are transferred to the income summary account.

- The income statement is used to record expenses and revenues. The income summary account is used to close out the books.

Closing the Income Summary Account

As discussed earlier, when choosing to close the individual accounts, a company can choose to directly transfer the balance of the accounts to retained earnings or go through an intermediate account called the income summary account. We have already discussed the pros and cons of each method in detail in the previous section. Choosing an income summary account to close the books will entail the following steps:

- The individual revenue and expense accounts appearing on the income statements are transferred to the income summary account. This can be done by debiting revenue accounts and crediting expense accounts.

- The balances of the amounts transferred should match with the net income or loss for the year for the company.

- The income summary account balance is then transferred to the retained earnings account in the case of a corporation or the capital account in the case of a sole proprietorship. This will mark the closing of the income summary account.

Income Summary Example

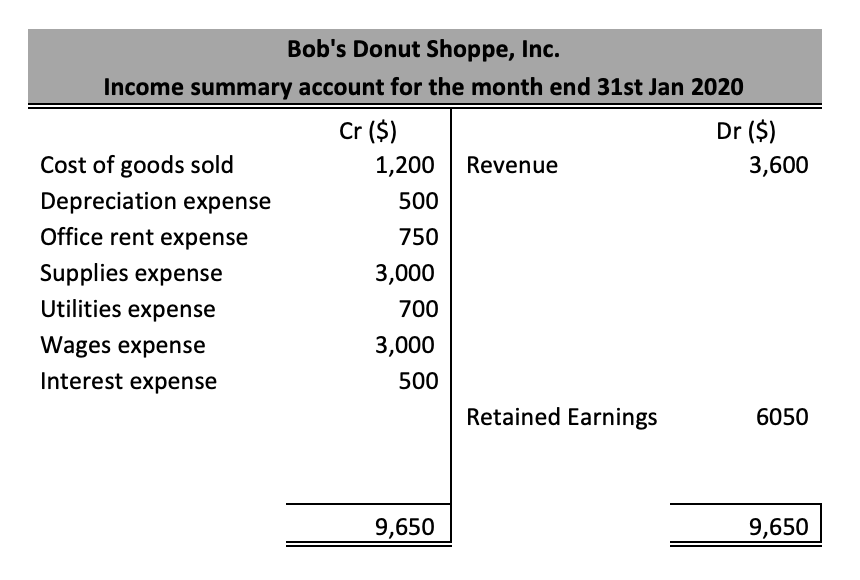

Continuing with Bob’s Donut Shoppe example, we see how the income statement to used to close out the temporary accounts of revenue and expenses and how the balances for these are shifted to the retained earnings account.

Bob’s Income summary account for the year should look something like this:

The following points are important to highlight related to the above income summary account for Bob and his company, Bob’s Donut Shoppe, Inc.

- Revenue accounts will appear on the credit side of the income summary account. This is because a revenue account in normal cases will have a credit balance.

- Expense accounts such as cost of goods, depreciation expense, office rent expense, supplies expense, utilities expense, wages expense and interest expense will appear on the debit side of the income summary account. These accounts have a normal debit balance.

- If the company has made a profit for the year, the retained earnings will appear on the debit side of the income summary account. If the company has instead made a loss during the year, it will appear on the credit side of the income summary account.

- Since Bob and his company has made a loss, therefore, the retained earnings account is appearing on the credit side or right-hand side of the income summary account.

Next Steps

The post-closing trial balance report lists down all the individual accounts after accounting for the closing entries. At this point in the accounting cycle, all the temporary accounts have been closed and zeroed out to permanent accounts. Therefore, a post-closing trial balance will include a list of all permanent accounts that still have balances. This will be identical to the items appearing on a balance sheet.