The post-closing trial balance report lists down all the individual accounts after accounting for the closing entries. At this point in the accounting cycle, all the temporary accounts have been closed and zeroed out to permanent accounts. Therefore, a post-closing trial balance will include a list of all permanent accounts that still have balances. This will be identical to the items appearing on a balance sheet.

The Accounting Cycle Example

Throughout this series on the accounting cycle, we will look at an example business, Bob’s Donut Shoppe, Inc., to help understand the concepts of each part of the accounting cycle. Below is the complete list of accounting cycle tutorials:

- Journal Entries

- T-Accounts

- Unadjusted Trial Balance

- Adjusting Entries

- Adjusted Trial Balance

- Preparing Financial Statements

- Accounting Worksheet

- Closing Entries

- Income Summary Account

- Post-Closing Trial Balance (you are here)

- Reversing Entries

We also have an accompanying spreadsheet which shows you an example of each step.

Click here to download the Accounting Cycle template

Post-Closing Trial Balance Purpose

The accounting cycle up till now already has seen the preparation of an unadjusted trial balance and an adjusted trial balance. Therefore, one might ask for the need of preparing yet another trial balance- the post-closing trial balance. There can be various reasons for preparing a post-closing trial balance. Some of them are listed below:

- To verify that all the temporary accounts have been closed off accurately

- To check if the debit and credit column totals match. If they do not, this could mean that there has been an error in journalizing the closing entries or while posting them to the ledger.

- The post-closing trial balance will reflect the final balances for the company accounts at the end of the financial reporting period. These ending balances will become opening balances for the next accounting period.

Format of a Post-Closing Trial Balance

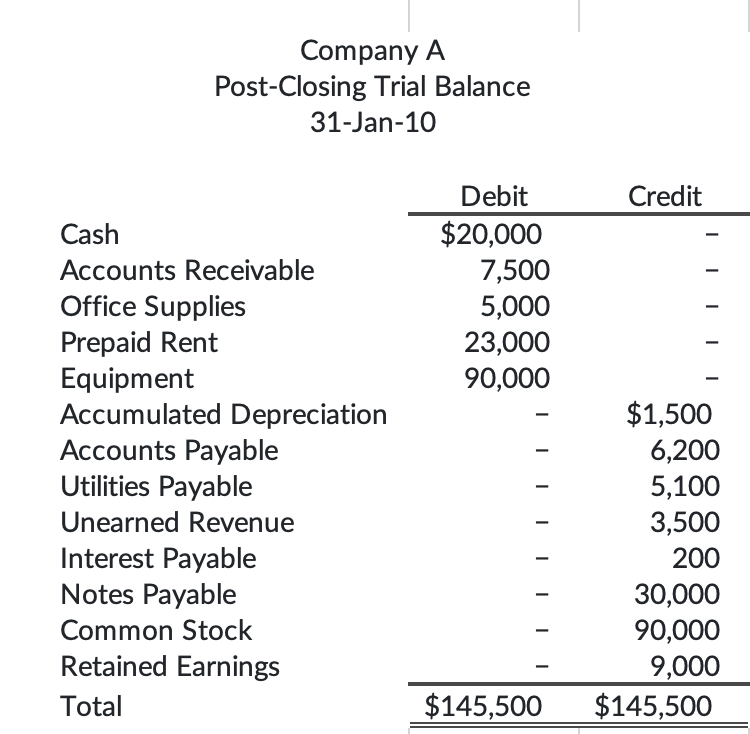

A post-closing trial balance will be formatted the same as the other two types of trial balances that have already been discussed. It will have three columns (account names, debit and a credit column). Like an unadjusted or an adjusted trial balance, it will have accounts listed in order of either their account numbers or in the order they appear on the balance sheet. The order that will follow will be assets first, then liabilities and finally ending off with equity.

Totals of both the debit and credit columns will be calculated at the bottom end of the post-closing trial balance. These columns should balance, otherwise, it would likely mean that there has been an error in posting of the adjusting entries.

The adjusted trial balance should have a proper header that should be in a similar format as below:

Company A

Post-Closing Trial Balance

As of January 31, 2020

Preparation

Preparing the post-closing trial balance will follow the same process that took to create the unadjusted or adjusted trial balance. Each individual account balance is transferred from their ledger accounts to the post-closing trial balance. All account with a debit balance will be listed on the debit side of the trial balance and all accounts with a credit balance will be listed on the credit side of the trial balance.

The difference between the unadjusted trial balance and the adjusted trial balance is the adjusting entries that are required to align the company accounts for the matching principle. Whereas, the difference between an adjusted trial balance and a post-closing trial balance is the closing entries that are required to close off the temporary accounts and transfer their balances to the permanent accounts so that they can be listed on the balance sheet.

Common Errors

Some common errors occur while creating the post-closing trial balance. Some of them are:

- The debit accounts are incorrectly listed as credit accounts or vice versa.

- Some accounts are mistakenly missed out on while posting to the post-closing trial balance.

- Some accounts are repeated multiple times.

- There has been an error in journalizing the closing entries in the preceding step of the accounting cycle.

The above-mentioned factors could be all those factors that result in the debit columns totals do not match with the credit column totals.

Example of a Closing Trial Balance

Company A prepares the following post-closing trial balance report after posting the closing entries:

As we can see from the above example, the debit and the credit columns balances are matching. This means that there is no error while posting the closing entries to their individual accounts and then listing those account balances on the post-closing trial balance.

Another thing to observe is that as expected we do not see any temporary account balances in the post-closing trial balance. All the revenue and expense accounts have successfully been closed out into an income summary account and then the income summary account balance has also been transferred to retained earnings account. The retained earnings account is a new permanent account listed on this trial balance which you won’t find in the trial balances (adjusted and unadjusted) that preceded the post-closing trial balance.

Bob’s Donut Shoppe, Inc Example

Continuing with Bob and his company, Bob’s Donut Shoppe, Inc., we need to post the closing entries to their relevant individual accounts and then list them on the post-closing trial balance. Bob’s closing trial balance should look something like this:

We can clearly observe the difference between the adjusted trial balance and the post-closing trial balance. All the temporary accounts like revenue and expense accounts have been closed out into the retained earnings account via the income summary account (as previously explained).

Another peculiar thing about Bob’s post-closing trial balance is that normally a retained earnings account will have a credit balance, but in Bob’s books it has a debit balance. The reason is that Bob did not make a profit in the first month of his operations. In fact, he made a net loss totalling $6,050.

Next Step

The next step of the accounting cycle is to prepare the reversing entries for the beginning of the next accounting cycle.